What is actually an excellent Robo-Coach?

“The typical retail trader having fun with a robo-coach could easily benefit from top-notch profile government at a price much lower than just you to usually recharged because of the an alive coach,” says Denerstein. Robo-advisers often have lower account standards than just old-fashioned brokerages and you will financing managers. Such as, Improvement has at least membership requirement of 0, if you are Wealthfront Investing’s robo-mentor has a minimum of 500. By comparison, Charles Schwab Wise Portfolios features no less than 5,000. When you are robo-advisers see ready takers one of millennials and you will GenX, it is smaller acknowledged certainly large-net-worth people who have a huge collection or those individuals seeking purchase a serious portion of the offers wallet.

Whether or not Elizabeth-Trade today relies on Morgan Stanley’s significant macro search prospective to possess investment industry assumptions on the key investment categories, the brand new investment team you to makes the brand new firm’s portfolios have not altered. Although business claims it utilizes mainly cheaper, beta-focused ETFs of third-party team, it’s hard to possess prospective traders to verify the brand new allege as opposed to an excellent complete list of holdings. The newest profiles are created becoming well-diversified, cost-productive, and you may supportive out of a long-term investment thinking you to definitely shies from specific niche issues. Profile allocations is practical, with minimal dollars allocations and you will adequate connection with big advantage classes. U.S. Bancorp also offers automatic rebalancing and you can tax-losses harvesting.

When you’re robo-advisors strictly conform to MPT because it makes up the newest key of its algorithms, financial advisors have more independence. An economic coach is additionally in a position to see investments away from ETF world, that’s in which extremely robo-advisors purchase. That it capacity to build head opportunities inside the specific places of one’s industry can cause outperformance, along with underperformance, rather than the fresh broader industry.

That’s as to why Forbes Mentor investigated those robo-mentor networks to identify the brand new ointment of one’s automated spending crop. Individual Financing Advisers demands a good 100,one hundred thousand minimum and you can charges 0.89percent AUM. In the high degrees of assets, clients can access estate and you will tax advantages too. By absolute amount of systems out there now, it could be daunting to find out the finest robo-advisor to you. That’s the reason we obtained a list of the major ten robo-advisers because of the quantity of customer money it perform, or possessions less than government (AUM). If you are biggest isn’t usually best, they have already a proven history in the industry and also have continuously mature their holdings throughout the years.

On the other side of the money, if you are looking to decide specific shares, you are upset for the quantity of independence a great robo-mentor offers. Old-fashioned brokerage companies often focus on traders with a bit far more investment, tend to demanding highest minimum deposits and you can charging highest fees — but also the accessibility to alive communication. An AI-founded robo-coach, as well, spends an analytical formula to evaluate the newest investor. However, do keep in mind you to 100 percent free advisors, if or not individual or robo, just who earn funds thanks to device manufacturers, may not be free out of bias. With this guidance, Charles Schwab’s algorithm can also be present a good hypothetical portfolio that have allocations to various form of brings, bonds and you may merchandise, and provide a general anticipate to the output.

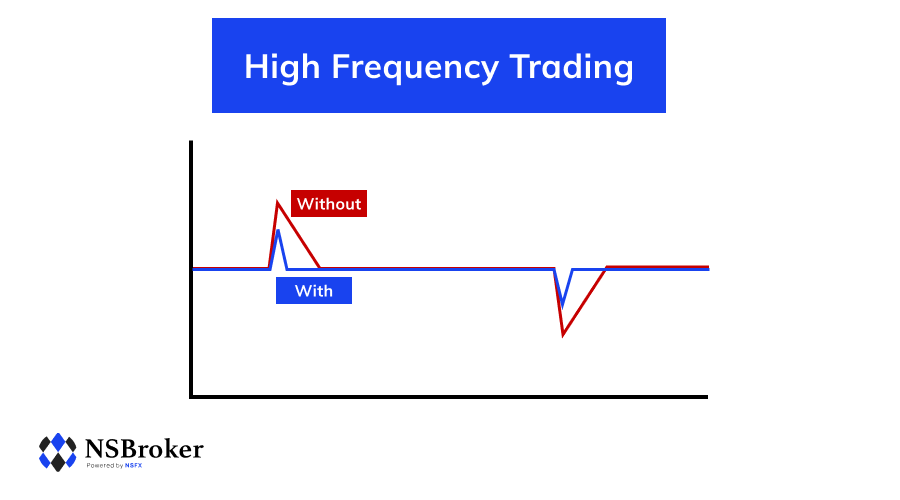

That with AI such as this, investors can also be function making smaller conclusion, and therefore maximises efficiency. As the 90s, AI’s part within field is actually usually restricted to algorithmic trade and you can decimal tips. An economic professional will offer suggestions in line with the suggestions offered and supply a no-responsibility label to raised understand your situation. Prices are among the many things whenever choosing an excellent robo-mentor.

You could potentially like private stocks and you may change-traded finance (ETFs) for the profiles, following M1 Fund can give full management. Just as very important, there are not any charge sometimes for choosing your own investment otherwise dealing with your bank account. Like those finance charges, robo-advisor administration charge try examined as the a keen annualized percentage of assets invested. Therefore if your average account balance is actually 50,000 in 2010 plus robo-advisor fees an excellent 0.25percent administration commission, the robo-coach often assemble a total of 125 away from you along side span of the entire year.

Vanguard’s profile framework strategy brings together relative ease which have modification. It’s over three hundred slides pathways, considering an investor’s needs, and position the path a-year as the model enters changes. Just in case robo-advisors sound like a great fit, consider all of our list of best organization to raised understand the alternatives which could meet your needs. An excellent robo-mentor will likely be a good choice for many kinds away from traders, depending on their needs and desire to handle their investment account. The word robo-coach sounds really highest-technology, nevertheless’s in fact less difficult than you may think.

To your confident side, UBS Information Virtue comes with usage of economic advisors along with profile diagnostics that have additional holdings. With a disappointing number of public information available, absolutely nothing borrowing from the bank will be given to it giving. Usage of a financial mentor and you can taxation-loss harvesting try a definite virtue.

And you may a failed acquisition of competing robo-mentor Wealthfront for the past 12 months brings up questions about how Information Advantage suits on the large UBS company. Once experiencing an initial chance survey, E-Trade assigns clients to one from half dozen address chance profiles, ranging from competitive to help you old-fashioned. It will not think risk ability otherwise to improve client portfolios based promptly views or paying requirements. That it not enough transparency in addition to helps it be tough to decide the newest capabilities of one’s firm’s collection-framework methods.

Offered its extensive label identification and enormous business-broad AUM out of 8 trillion worldwide, it’s no wonder one Leading edge is even a heavyweight in the arena of robo-advisors. No more than the sole set of people just who may possibly not be searching for M1 Finance is mind-led people. There aren’t any profits to have including otherwise deleting securities out of your pies. You could generate as numerous pies as you wish, and you may like to put otherwise get rid of securities from your own pies any moment. The application of fractional shares will enable you to hang slices of higher-charged bonds on your pies.

The support agreed to members who decide to discover constant advice will vary centered the level of possessions inside the a collection. Please opinion the form CRS and you may Cutting edge Private Advisor Features Brochure for important details about this service membership, as well as its investment centered services accounts and payment breakpoints. Robo-advisors, such traditional advisors, remind customers in order to decrease threats due to variation. To get into Betterment, perform a merchant account, see your aims and you may enter several personal details.

Robo-advisers give a hands-from method for a myriad of people, regardless if you are only starting otherwise a talented investor who would like to put your assets hands free. Morgan, for example, basically form with at least 50,100000 worth of investable property, for each and every their site. To have wide range administration solution at the Fidelity, the website says that you have to provides at the very least 250,one hundred thousand invested in eligible Fidelity membership(s) and you may a great 50,one hundred thousand membership funding minimum. Enhanced variation is actually laudable, however, tricky inclusions in the customer profiles are nevertheless.

M1 Finance are based because of the Brian Barnes inside 2015 which is based inside Chicago. The firm extremely is different from the entire pool away from robo-advisors because prizes pages far more discretion within their portfolio choices than other networks. Where M1 intersects together with other automated investment systems is within rebalancing. Just like Wealthfront, M1 also provides pre-produced, expertly tailored profiles, named Pies, and also the thinking-directed inventory and you can ETF possessions will be rebalanced to the new user’s common resource allotment. That said, of a lot company give entry to individual advisors readily available for issues related in order to membership management or a lot of time-identity financing thought — even though these types of services may cost much more.

Exactly how Robo-Advisor Profiles Is Created

Automatic portfolio rebalancing is included, but tax-losses picking isn’t available and you can fractional shares are only offered on the reinvested dividends. Following, which young investor need to look from the just how many out of the reduced-rates platforms have taxation-advantaged 401(k) otherwise IRA account (or 403(b), rollovers, or any other account versions you to definitely specifically use). Similarly, a person preserving for university would likely focus on those individuals robo-advisers that provide 529 agreements otherwise custodial accounts. For these looking earliest membership management functions, although not, no special membership is required.

An individual https://www.ovforum.org/immediate-momentum-comprehensive-review/ wealth advisor could be the best option for individuals who you desire validation or a personal dialogue prior to a good investment. Although not, if you need easier deal and you can ready accessibility, a good Robo-coach ‘s the path to take. To your average percentage falling ranging from 10 bps and 50 bps, perhaps the paid off robos offer extremely relatively-cost services. Because of the full set of functions, such investment tracking, robos are indeed really worth which price.

Certain robo-advisers charge zero management charges and offer just limited independency. Anybody else offer all of the bells and whistles you could require — and you may charges appropriately. However they usually want a premier minimum funding, possibly from the half dozen numbers. Originally, robo-advisors slash individual advisers outside of the visualize entirely.

The number of robo-advisors has swelled within the last 10 years, while the has got the set of features. Betterment has an array of characteristics, especially offered its less than-mediocre price. They charges an excellent 0.25percent investment-based annual commission to possess automated collection government.

Inside 2008, technical business owners Dan Carroll and you may Andy Rachleff co-founded the widely used robo-mentor provider Wealthfront. Because the the inception, Wealthfront is just about the direct of your own robo-mentor development category. From a basic formula-driven digital funding director, the organization has exploded to incorporate hundreds of ETFs to include to the first Key and you may ESG robo-advisory portfolios. Pages may perform their own ETF profiles for Wealthfront in order to create. By the addition of an automated bond collection and you can percentage-100 percent free trading and investing, very buyers can meet its monetary needs that have Wealthfront. Speaking of for example administration charges, merely it’lso are paid back not to ever the fresh robo-mentor, but on the investment the fresh robo-coach spends.

Ask an economic Elite People Concern

Robo-information appears safe for today, but the retreat out of a buyers-focused team raises some suspicion to own buyers right here. Robo-advisors basically fees yearly administration fees away from 0.25percent so you can 0.50percent of your assets lower than administration (AUM), even though some fees a predetermined monthly subscription fee as an alternative. Lower fees compared to the antique monetary advisors are considered among the key great things about robo-advisors. Marcus Dedicate also offers a solid robo-mentor services that will interest such to help you people who have a premier-produce bank account to your on the web bank. The newest annual management payment is good to the community standard during the 0.a quarter, however, all financing money can be acquired for under 0.20% with a few only 0.05 per cent.

Nonetheless, Improvement also offers sturdy key funding and you will monetary thought choices from the sensible will set you back, and its webpages gives investors a whole lot to read through before they dedicate. It’s a robust rival, specifically for traders looking for a clean, easy-to-play with interface. As well as diversification, really robo-advisers give automatic collection rebalancing and, increasingly, tax-loss picking. Collection rebalancing helps ensure you retain the proper harmony away from money types to be successful as the business requirements change, and you can income tax-losses picking will help reduce steadily the count your debt long term for the financing progress fees.

Because of the attempting to sell a protection baffled, buyers stop paying taxes thereon earnings. Risk-looking to people usually choose riskier investments offering highest perks. Risk-averse people normally discover safe opportunities, although they can get read seemingly straight down efficiency. To possess advice about the newest membership position out of 11 Monetary, please contact the state securities government of these claims in which 11 Financial retains an enrollment filing.

Robo-advisers typically cost you out of below 1percent of the collection worth. Should your funding means try couch potato and also you do not require person information or advice, a good robo-coach will be greatest. Suppose you’d rather speed up all the process and so are shameful revealing your investment alternatives with people.

Eventually, robo-advisors is earn money from the product sales focused financial products and you can services on their users, including mortgage loans, playing cards, otherwise insurance rates. This could be complete thanks to proper partnerships as opposed to advertising communities. All the investing try susceptible to risk, like the you are able to loss of the money your dedicate. For more information from the Innovative financing and you can ETFs, go to innovative.com to locate a great prospectus or, if available, a summary prospectus. Financing expectations, dangers, charges, expenses, or any other important information in the a finance try contained in the prospectus; understand and you will contemplate it cautiously just before investing.

Betterment brings together client purchase and you may resource rebalancing that have taxation-losings harvesting to make certain optimum immediately after tax statements. To stop the brand new wash sales laws, Improvement maintains a summary of comparable financing per advantage category to maintain smooth diversity. Being a referral partner has an effect on and that points we come up with and you may in which and how this product looks to the our very own webpage. Above all, but not, the content of our own analysis and you may reviews is actually purpose and so are never ever affected by our very own partnerships. Consequently, they must be registered on the SEC and they are at the mercy of a comparable bonds laws since the traditional broker-investors. It’s well worth bearing in mind the Internal revenue service wash-sale laws suppresses traders out of lso are-purchasing the exact same shelter otherwise a protection which is significantly identical inside 30 days from its offer date.

Simultaneously, Merrill Border offers an online Directed Paying membership that have a-1,000 minimal. Finally, there is certainly the top-of-the-line Guided Paying, doing at the 20,000, and that brings together a good robo-coach that have you to definitely-on-you to definitely person profile government and you can information. An informed on the web brokerages for starters, in addition to robo-advisers, are great for people with minimal paying feel and you can a preference for couch potato investing. Beginner-amicable programs are reduced-costs, taking instructional info, cellular exchange availability, and you will staking award have. However, the Wealthfront’s strategic pivots search motivated because of the common yet not necessarily sensible funding manner.

Improvement try one of the first robo-advisers to hit the market industry in the 2008, possesses managed the an excellent reputation since. There is no minimal harmony you’ll need for Betterment Electronic Paying, and the yearly membership fee try a minimal 0.25percent of one’s money balance. Enable opted from our very own robo-advisor questionnaire, which limits every piece of information accessible to what can end up being gleaned of public disclosures.

Such innovations are extremely very theraputic for people in underserved organizations otherwise that have limited savings. It’s got the possibility to alter monetary literacy due to strengthening anyone making best economic choices. A survey authored within the 2023 showed that there have been a good type of surge inside the young people having fun with robo-advisers. Specific 31percent out of gen Zs (created after 2000) and you will 20percent out of millennials (created ranging from 1980 and you may 2000) are utilizing robo-advisers. The newest authors don’t benefit, demand, very own offers inside or discover financing of any organization otherwise organization who take advantage of this informative article, and possess disclosed no relevant associations past the instructional appointment. CFI ‘s the authoritative merchant of the Investment Areas and you can Securities Specialist (CMSA)™ degree system, made to changes someone on the a scene-classification economic analyst.

Of a lot or the issues looked here are from your people whom make up united states. So it impacts and this items i write on and in which as well as how this product appears for the a full page. ¹Forbes Advisor receives bucks compensation from Wealthfront Advisors LLC (“Wealthfront Advisors”) for each the new client one is applicable for a good Wealthfront Automatic Paying Membership due to all of our backlinks. Forbes Coach isn’t a Wealthfront Advisors client, and this refers to a paid acceptance. Forbes Advisor get payment when your readers provides particular personal information in order to Leading edge immediately after pressing Find out more.

And make payment on robo-advisor’s government payment, if there is you to, traders along with pay fund charges named costs percentages. I rated the brand new automated using provider Schwab Smart Portfolios an informed in making a big put while the traders want to make an excellent 5,000 lowest deposit to discover a free account. On top of this, hefty can cost you, steep account minimums, and you may terrible openness are nevertheless significant disadvantages to have UBS Advice Virtue. The brand new program’s yearly fee cities that it giving among the most costly robo-advisers i analyzed. The individuals charges come in introduction on the debts ratios on the root money utilized in the applying, which are tough to determine because the UBS will not divulge and that financing are used in the profiles. In the a simple broker account, you could shell out a fee to buy otherwise sell investments, both during the a good rebalancing of your own profile and when your deposit otherwise withdraw currency.

Best for Females People

Such, robo-advisors explore computer system formulas to provide lowest-rates advantage allotment and construct automatic individual portfolios. They provide a lot more specificity than the straightforward change execution from a brokerage platform however around the newest customization you would get from a living, breathing money manager. It’s vital that you just remember that , a key benefit of robo-advisors is that you basically don’t purchase the private securities and you will ETFs that define the profile. Robo-advisers pre-see lowest-costs list fund ETFs (and sometimes other investment, such as mutual money). These are generally wide-business money you to definitely buy You.S. stocks, international carries, ties and you may real estate investment trusts (REITs). You might be capable like themed portfolios, such a socially in charge investing collection.

The brand new 17 advantage categories picked to the portfolios defense holds, securities, and you will rising prices property, to give the best built profiles on the robo-consultative group. Robo-advisors play with complex application to handle a number of the tasks one to used to wanted high priced benefits to manage. Services range from automatic rebalancing so you can taxation optimization, and want virtually no people interaction.

Ask a concern about your finances taking as much detail that you could. Our very own creating and you may article team are a small grouping of pros holding advanced financial designations and also have authored for many major financial mass media publications. The performs might have been in person cited by the groups along with Business owner, Organization Insider, Investopedia, Forbes, CNBC, and others. At the Financing Strategists, i mate with financial experts to guarantee the reliability of our own monetary articles.

If you would like to buy private brings, you’ll should purchase dozens of these to decrease their risks. If you are Road helps you policy for the next, Autopilot helps with the treating your money in the current. That it equipment instantly distributes their salary to different economic profile, from the savings account to an emergency fund and your investment account, to satisfy your entire various other means and desires. SoFi Automated Investing runs just about since you you are going to expect out of an excellent robo-mentor.